As containment measures force billions of people to work, study and play games at home during the new outbreak of Covid-19, usage has increased exponentially for Cloud Computing services that are behind video conferencing like Microsoft Teams and Google Meet, streaming and online games.

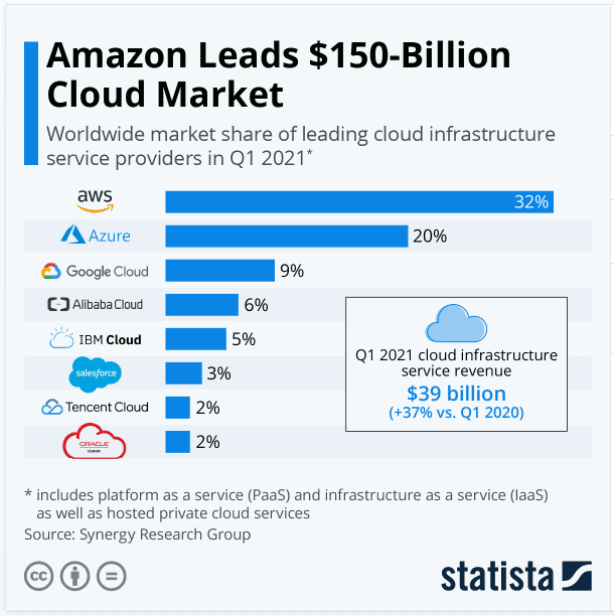

The world's top three cloud service providers – Amazon Web Services by Amazon.com Inc, azure from Microsoft Corp and Google Cloud from Alphabet Inc – have seen demand for their services jump in the last month.

In particular, the daily usage spike for Google's Meet video conferencing tool has increased 30 times since January, while the number of daily users for Microsoft's Teams chat system has more than doubled to 75 million since early March.

But at the same time, companies saw a drop in new contracts from large customers for basic server infrastructure such as storage, processing and memory. Enterprise IaaS contracts from 12 to 36 months typically represent a larger share of revenue than contracts for video conferencing software like Teams and Meet that are SaaS, all cloud computing.

Free Cloud Computing and usage limits

Delays in creating new server environments and free trial offers also limited sales growth in the first quarter.

For example, Microsoft said it placed limits on the amount of cloud computing that new customers could consume due to resource scarcity due to Covid-19.

“We're generally using servers and infrastructure that we've already purchased… because the ability to get tons and tons of new servers with the supply chain outside of China has been limited”, Microsoft Chief Financial Officer Amy Hood said in an interview with Reuters.

Cloud providers reported first-quarter revenue growth of about 34%, less than the fourth-quarter growth of 37%, according to research firm Canalys.

“Cloud investment in the most affected segments such as hotels, aviation, construction, tourism and manufacturing is being reduced or delayed,” Canalys said in a report on Thursday. "This offset some of the short-term growth enjoyed during the quarter."

It's still unclear whether cloud providers see a boost to global pandemic revenue growth in the current quarter or later this year.

Businesses and governments have begun to transition from implementing emergency measures to preparing for reopening in the coming months, but their healthcare budgets to fight Covid-19 could reduce spending and force cloud providers to extend their free offerings.

IDC last week downgraded its forecast for global IT spending in 2020 to a decline of 2.7% compared to a previous estimate of a 3.6% increase because of the pandemic.

DELAYS IN MAJOR PROJECTS

Microsoft Azure, which is number 2 in cloud computing revenue after Amazon Web Services, saw its sales growth rate decelerate further, at 591TP1Q in the first three months of the year, versus 621TP1Q in the previous quarter, company data showed.

One of Microsoft's biggest sources of revenue is large companies that face complicated technology issues, such as moving entire ERP systems to Microsoft's cloud from their own servers.

Microsoft executives said this week that while large companies like Anheuser Busch InBev NV continue these migrations to Cloud Server, the consulting revenue growth that often accompanies these complex projects has slowed as customers put off projects.

About a fifth of the cloud computing revenue of the Microsoft Azure may face volatility in the next quarter because of these delays, the company said.

Google's chief executive, Sundar Pichai, also said this week it was taking longer to close deals in a cloud, but did not offer revenue guidance.

In the first quarter, Google Cloud revenue, which includes sales of storage services and software in the workplace, grew 521TP1Q year-on-year, compared to 531TP1Q in the previous quarter.

John Dinsdale, chief analyst at Synergy Research Group, said that while some buyers are putting off projects, their plans to adopt more cloud services have not changed.

"The signs of a good business for Cloud Computing and for the top cloud providers they remain very positive,” he said.

Amazon, which saw Amazon Web Services AWS revenue growth drop to 331TP1Q in the first quarter from 341TP1Q a quarter earlier, pointed to an increase in IR instance booking contracts as evidence that its business remains healthy.

But Covid-19-related constraints and shortages could hamper future revenue growth. Google said it could face delays in developing new data centers, and Microsoft's Hood told Reuters that delays in building the data centers will persist.

“We will continue to follow government guidelines and will return to construction when it is safe to do so,” said Hood.

Source: Paresh Dave, Reuters May 1, 2020

Tag: Cloud Management, IT Governance, Corporate Governance,